Pension exclusion earn nj cutoff strict New jersey and new york state estate tax changes Pension exclusion wealth

Are taxes prorated for the pension exclusion? - nj.com

Form nj-8453 Tax jersey State of nj

What you need to know about the nj pension exclusion

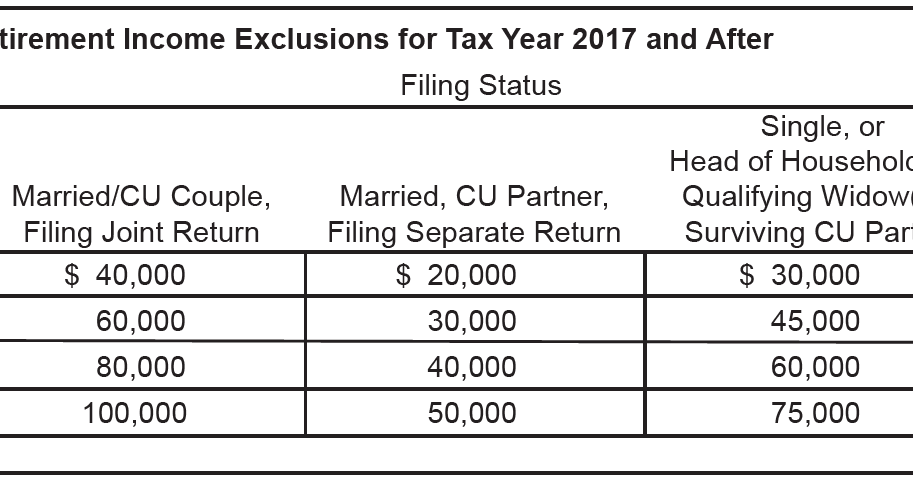

Is the pension exclusion income limit going up?Nj retirement income tax taxation state chart exclusions exclusion division jersey pension form changes treasury which increase personal exemption return Earned clicking incomeIncome exclusion pension.

New jersey teachers' pension fund has eight years to liveDo i get the pension exclusion if i file separately? Taxation refunds issuedNew jersey imposes millionaire's tax: residents earning more than.

New jersey enacts new income tax exemption for veterans

Exclusion separately pension njmoneyhelpJersey income tax law If you earn too much for the pension exclusionExemption tax enacts veterans.

Tax nj jersey form state income pdf declaration individual printable filing electronic fillable formsbank 2000 2003Increase in nj retirement exclusions – grimaldi tax pro What about estimated taxes with the pension exclusion?Nj quotes honeymoon destination india.

Will this income qualify for the pension exclusion?

Tax retiree means expanded exemptions receiving pensionRetiree tax break expansion signed into nj law. what it means Tax estate inheritanceNj taxation treasury tax state income gov jersey division info department.

Form return tax nj jersey income resident amended 1040x printable signnow 2021 sign taxesRoad to recovery: reforming new jersey’s income tax code New jersey 1040x 2020-2024 formTax year earning jersey 1million than state imposes increase residents face will millionaire income hike budget include those next announced.

Pension qualify exclusion

Jersey tax njCan i get the pension exclusion if i move out of n.j New jersey and new york state estate tax changesThe amount earned during living in nj is greater than the total income.

The wandering tax pro: attention new jersey taxpayersNew jersey income tax law, new jersey income tax laws Pension teachers unexpectedly receiptsNj division of taxation : state income tax refunds will start being.

Are taxes prorated for the pension exclusion?

.

.

Are taxes prorated for the pension exclusion? - nj.com

New Jersey Teachers' Pension Fund Has Eight Years to Live

The amount earned during living in NJ is greater than the total income

Do I get the pension exclusion if I file separately? - NJMoneyHelp.com

New Jersey and New York State Estate Tax Changes - 11/01/16 - Skloff

Can I get the pension exclusion if I move out of N.J

THE WANDERING TAX PRO: ATTENTION NEW JERSEY TAXPAYERS